placer county tax deed sales

HUD Homes USA Can Help You Find the Right Home. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner.

Washington Legal Blank Forms Stevens Ness Law Publishing Co

Please contact the Procurement Services Division at 530-886-2122 if you have any additional questions.

. General Information The information presented below is for general information purposes only. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Here is a summary of information for tax sales in California.

Placer County Recorder-Clerk 2954 Richardson Drive Auburn CA 95603 By Telephone Official records may be ordered over the phone with a credit card. Redemption Period 2 to 3 years if tax lien auctions are held but varies depending on the county. Our phone number is 386 313-4375 for the Tax Deed line and our Records office phone number is 386 313-4360.

Zillow says the attractive 4 BR 1BA home is worth about 45000 with a high value of 61000. Unpaid real estate taxes creates a serious cash-flow problem for Placer County. Please register as a bidder online with BID4Assets.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Placer County CA at tax lien auctions or online distressed asset sales. At any time in the process the property owner can stop the tax deed by paying all taxes due interest and fees. The opening bid was 500 a huge value even if it needed some work.

The Sales Comparison method entails contrasting present like houses sale prices in the same locale. After a tax deed application has been filed it takes 3-6 months for a property to go to auction. The minimum combined 2022 sales tax rate for Placer County California is 725.

They are maintained by various government offices in Placer County California State and at the Federal level. Minnesota is one of many tax deed states and Pipestone County sells homes every year. The County of El Dorado will be utilizing an online tax sale module called BID4ASSETS.

Collier County Clerk of the Circuit Court Comptroller 3315 Tamiami Trail East Ste. What is the sales tax rate in Placer County. Ad Find Placer County Online Property Title Report Info From 2021.

The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County Groceries are exempt from the Placer County and California state sales taxes Placer County collects a 125 local sales tax the maximum local. To order by phone call 530-886-5610. They are a valuable tool for the real estate industry offering both buyers and sellers detailed information about properties parcels and their.

For more info please contact us at 727-464-3409. The 2018 United States Supreme Court decision in South Dakota v. However California is a good state for tax deed sales.

This is the total of state and county sales tax rates. Assessor Clerk-Recorder Revenue Services Treasurer-Tax Collector. Transient Occupancy Tax Check out information and services such as online payments finding your tax rate and setting up auto payments.

Everyone is happy Placer County California recovers lost tax revenue the purchaser acquires title to the tax delinquent property free and clear of all. Property Tax Rates Allocations Direct Charges Access property tax information and assessed values by taxing entities. The California state sales tax rate is currently 6.

Ad Find Tax Foreclosures Under Market Value in California. Upcoming Auctions MARCH 31 2022- Public Auction Tax Sale will be online utilizing BID4ASSETS. Placer County relies on the revenue generated from real estate property taxes to fund daily services.

Any restrictions or limitations such as minimum bids will be clearly identified on the specific items posted. Payment Types Checks - The Recorders Office does accept personal checks. The sale vests in the purchaser all right title and interest of Placer County in the property including all delinquent taxes which have become a lien since issuance of California tax deed.

Name Placer County Recorder of Deeds Suggest Edit Address 2954 Richardson Drive Auburn California 95603 Phone 530-886-5600 Fax 530-886-5687. Should the sale be considered invalid the tax deed will be rescinded and the buyer will receive a full refund of the purchase price. Photos of the items are posted for you to examine prior to submitting a bid.

It is not to be taken as advice or used as guidelines for any kind. Public auctions are the most common way of selling tax-defaulted property. Buyers should be aware that a rescission of the sale could occur although very rarely.

Pursuant to California Revenue and Taxation Code RTC section 37005 the county tax collectors are required to notify the State Controllers Office not less than 45. SW Edgerton was one that went to the sale. General Information - Claim for Excess Proceeds.

California Tax Lien Auctions No tax lien sales have been held to date. The auction is conducted by the county tax collector and the property is sold to the highest bidder. Placer County Recorder of Deeds Contact Information Address Phone Number and Fax Number for Placer County Recorder of Deeds a Recorder Of Deeds at Richardson Drive Auburn CA.

The Placer County sales tax rate is 025. An Income Method for commercial properties estimates the future business income to determine current fair market worth. Non-Criminal Orders to Seal.

Once tax deed begins all outstanding taxes fees and interest must be paid. The ability to challenge a sale extends one-year from the date tax deeds are recorded. Click Here to be redirected to their website.

Tax deed sales in Bay County require a 200 or 5 deposit for the winning bid. Ad Register for Instant Access to Our Database of Nationwide Foreclosure Listings. For an additional charge telephone orders can be sent via express courier or emailed.

With many versions there are three main appraisal approaches for evaluating a propertys worth. Auctions are held on a rolling basis so youll want to check in often to see when they are occurring and what properties are coming available. One Simple Search Gets You a Comprehensive Placer County Property Report.

If Placer County. Interest Rate 18 if tax lien auctions are held. Placer County sells tax deed properties at the Placer County tax sale auction which is held annually during the month of October each year.

Full payment must be received within 24 hours of placing the winning bid.

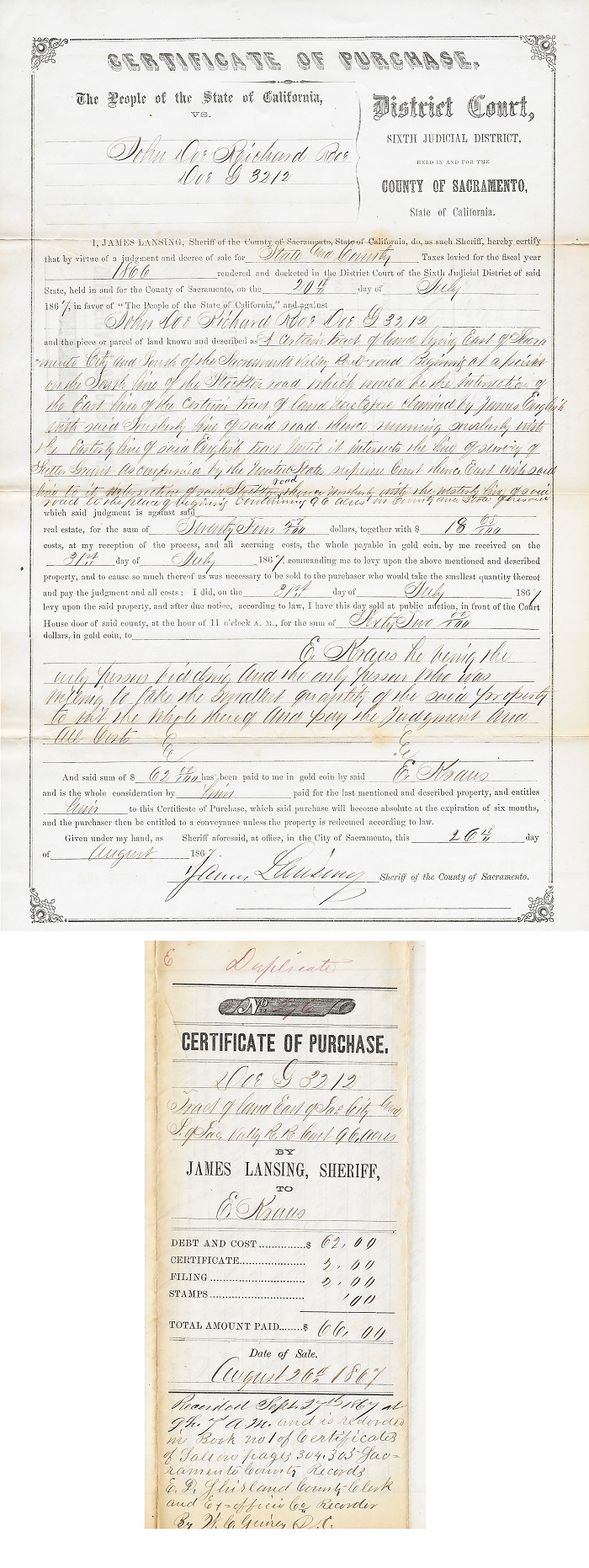

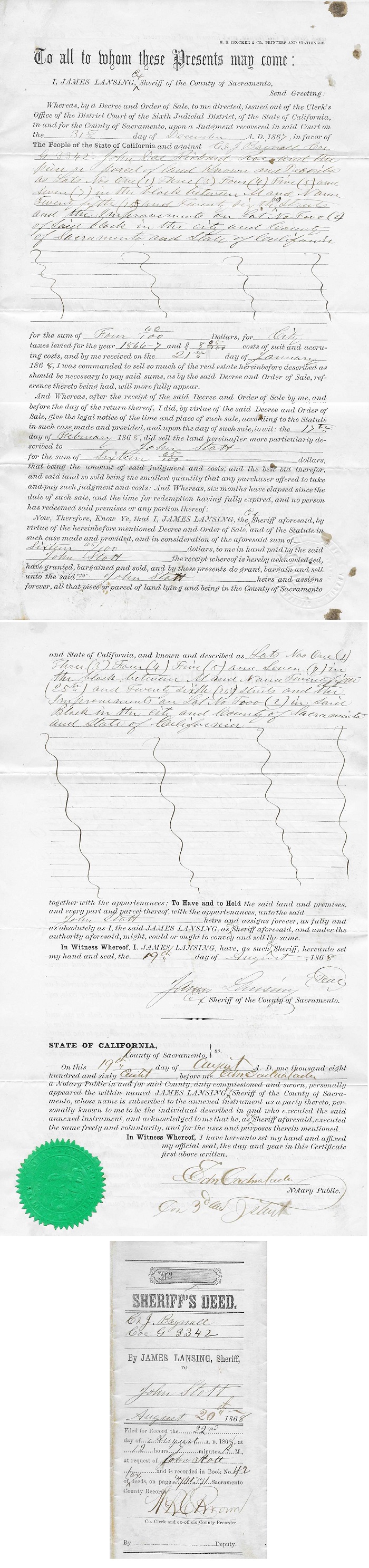

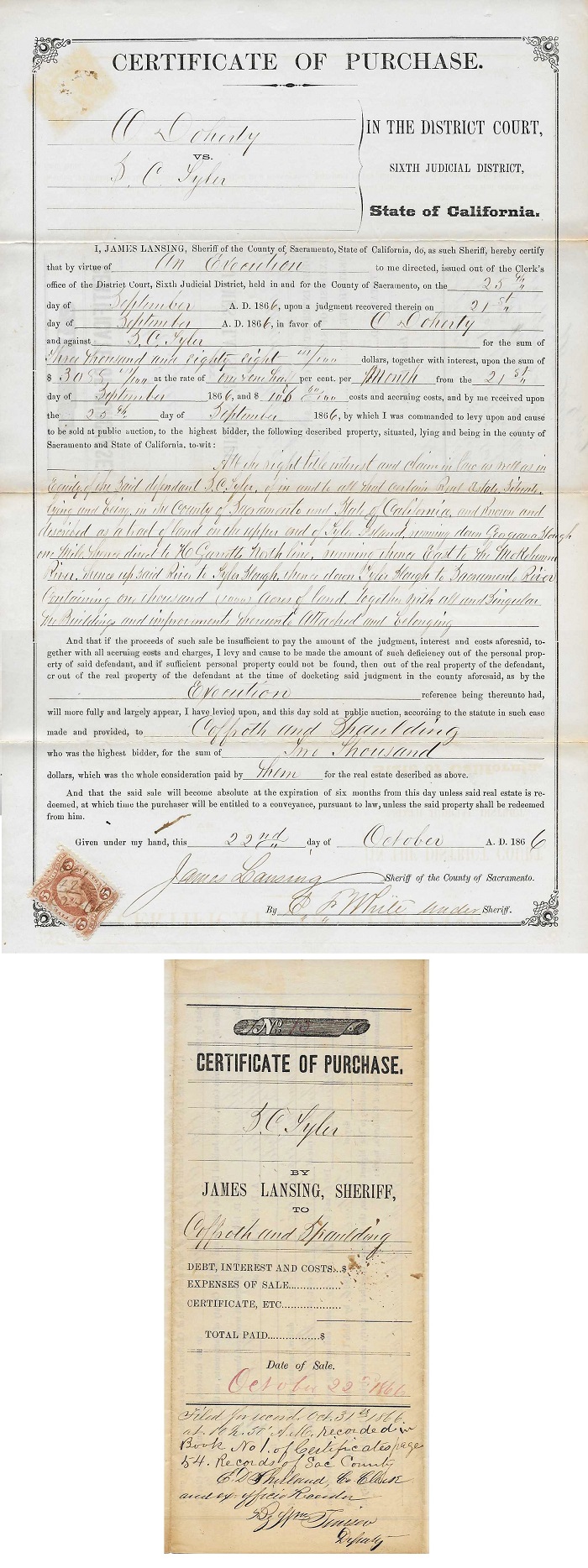

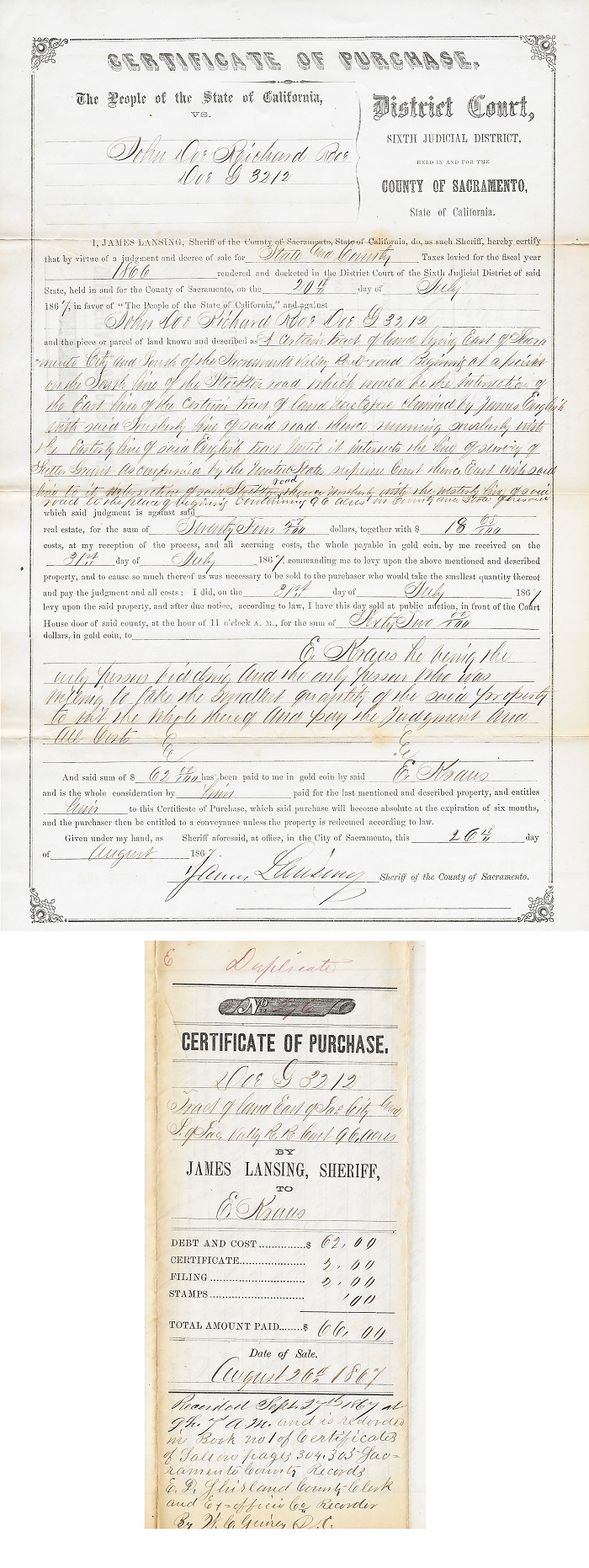

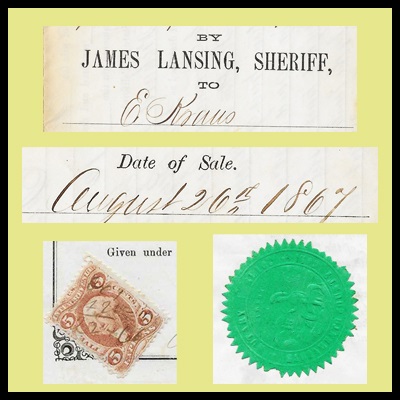

Early Sacramento Sheriff Sale Documents Of James Lansing From 1860s

Find The Best Rate For Home Loan Dhfl Compare Offers Across Banks In Pune For Home Loan Apply Online Www Dialabank Com Article Cfm Articleid 2290 Pinterest

Early Sacramento Sheriff Sale Documents Of James Lansing From 1860s

Washington Legal Blank Forms Stevens Ness Law Publishing Co

Bitcoin 185 Bitcoingenesis Opensea

Washington Legal Blank Forms Stevens Ness Law Publishing Co

Early Sacramento Sheriff Sale Documents Of James Lansing From 1860s

2429 Placer St Redding Ca 96001 Zillow

State Of Nevada Marriage Certificate Issued By Lawrence R Burtness Washoe County Recorder Nevada Washoe County Carson City

With Rv Or Boat Parking Homes For Sale In Fairfield Ca Realtor Com

Washington Legal Blank Forms Stevens Ness Law Publishing Co

City S Cathy Adams Seeks Miss New Jersey Title On Line

12554 Blinnwood Ln Houston Tx 77070 Realtor Com

1348 Avenida Alvarado Roseville Ca 95747 Zillow

With Big Lot Homes For Sale In Shingle Springs Ca Realtor Com

Early Sacramento Sheriff Sale Documents Of James Lansing From 1860s

With Vaulted Ceiling Homes For Sale In Camino Ca Realtor Com