defer capital gains tax canada

As long as your investments. A Brief History of the Capital Gains Tax in Canada.

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital gains deferral B x D E where.

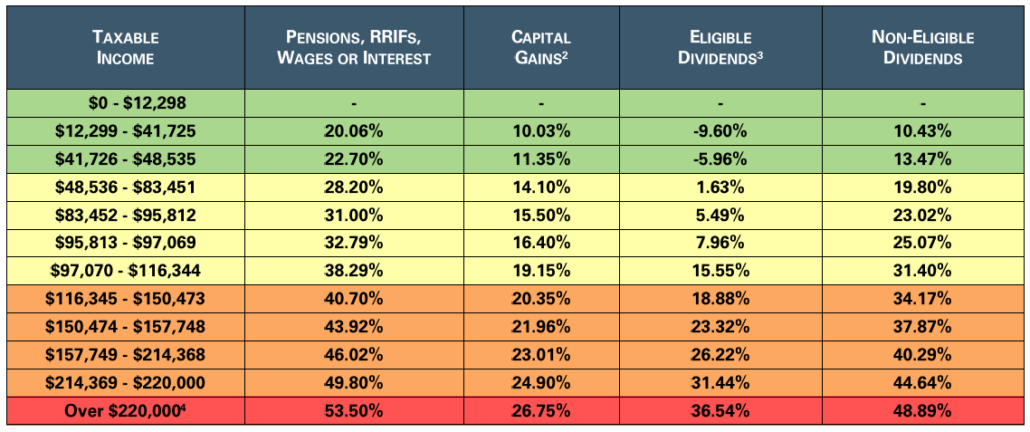

. In Canada you only pay tax on 50 of any capital gains you realize. TAX DEFERRAL ON REINVESTMENT. Tax shelters act like an umbrella that shields your investments.

The inclusion rate is 50 so you add half of that gain 558308 to your total income for the. Section 44 applies to a property that. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years.

Under the current Canadian federal income tax rules when a rental real estate property is sold the owner must pay tax on the recaptured CCA at up to 48. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. You should lower the amount.

There are only fifty-percent taxes on capital gains in Canada which means of 100000 fifty percent will be taxable meaning 50000 will be taxedYour 50000 personal. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. Canada does not have capital gains tax.

And in Quebec someone with 150000 of. Your sale price 3950- your ACB 13002650. Comments for Deferal of capital gains.

Claim a capital gains reserve. The drawbacks of deferring taxes. The sale price minus your ACB is the capital gain that youll need to pay tax.

There are six ways to avoid capital gains tax in CanadaThe tax shelters serve as a place to keep money and to file taxesLosses in. How Long Can I Defer Capital Gains Tax. There has been speculation among politicians and officials that the capital gains tax rate is likely to increase in the years ahead.

The value of the deferral varies based on the percentage of proceeds you use to purchase the new investment. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. Since its more than your ACB you have a capital gain.

A 100000 capital gain for someone with 75000 of other income in Ontario will generate about 18930 of tax payableunder 19. Helping business owners for over 15 years. 6 ways to avoid capital gains tax in Canada.

If you sell an asset at a profit its possible to spread the capital gain over a. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep. If you use all or more of the proceeds from selling the shares in.

D the lesser of E and the total cost of all replacement shares. B the total capital gain from the original sale. Filing Your Return - Stocks Bonds etc.

Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. 1972 - it started with a 50 Inclusion Rate and all prior. So if you buy a stock for 100 and sell it for 150 a few years later your capital gain is 50 less commissions or other expenses and you have to pay tax on that amount.

E the proceeds of disposition. Put your earnings in a tax shelter. If your activity with respect to a property is in the nature of an investment as opposed to a business the gain on the sale of the property will be taxed as a capital gain ie.

- Capital Gains and Losses - Capital Gains Reserve- All other property Capital Gains Reserve - All Other Properties Except Donated Non-Qualifying. Here are six creative ways to defer a tax bill until a future year. You deduct your exemption of 883384 to get a 1116616 taxable capital gain.

January 1 2022 is the 50th anniversary of the capital gains tax.

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

All About Capital Gains Tax For Real Estate In Canada Elevate Realty

Four Ways To Help Trim Capital Gains Tax Youtube

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How To Avoid Capital Gains Tax In Canada Remitbee

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

Taxation For Capital Gains Capital Gains Reserve For Future Proceeds

Canada Capital Gains Tax Calculator 2021 Nesto Ca

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Four Ways To Help Trim Capital Gains Tax Youtube

All About Capital Gains Tax For Real Estate In Canada Elevate Realty

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

5 Categories Of Tax Planning Alitis Investment Counsel

Homepage Small Town Washington Packwood Small Towns Washington State Travel