how to open tax file in bangladesh

The tax authority said the online return filing. INCOME tax return means submission of return of income in the prescribed form to the Deputy Commissioner DC of Taxes by a person whose total income during.

Online E Tin Registration And Income Tax Return 2021 22

The standard rate of VAT in Bangladesh is 15.

. In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income. An individual can follow two procedure to file the return one is universal self assessment procedure and normal procedure. You can calculate yo.

Companies have to file their tax returns within Tax day. Bank Statement 01-07-21 to 30-06-22 3. For individual tax returns select Other than Company Form next to Tax Type and IT-11GA Tax return for other than Company next to Tax Form.

An overview of Individual Income Tax in Bangladesh. An overview of Individual Income Tax in Bangladesh A countrys great source of income is its population. An overview of Individual Income Tax in Bangladesh A countrys great source of income is its population.

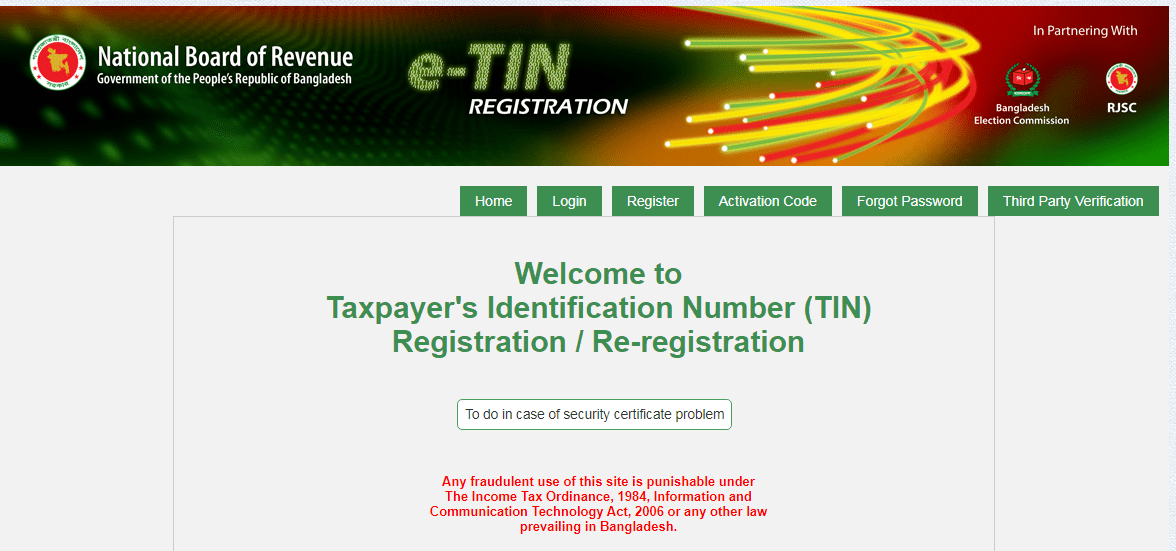

From the homepage Taxpayer clicks Register Account tab. Manage your source tax for withholding agents Interact online with tax support team. The return has to be accompanied with audited statement of accounts computation of total income along with supporting schedules for.

Copy of eTIN 2. C if the person is-. A code is sent to the number and this code shall be used to obtain User IDPassword.

Tax return filing and tax payment relief measures COVID-19 Bangladesh. It was established by the father of the nation Bangabandhu Sheikh Mujibur Rahman under Presidents Order No. It is a system guided easy-to-use tax preparation software that will save you time money and help you reduce any tax potential audits by the Government.

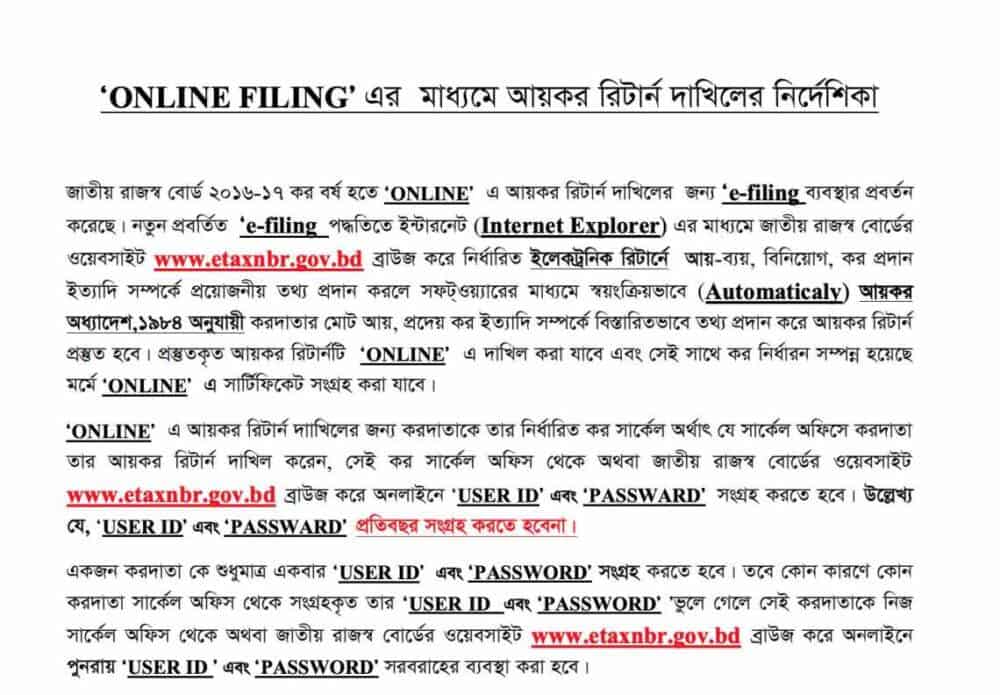

In order to verify a persons status of income and assets he has to submit an annual tax return copy to the government in prescribed manner. At First Visit the Website httpssecureincometaxgovbdTINHome Create a User ID by proving necessary informations in the Registration form In order to obtain a User ID and password to open an account a phone number needs to be provided to the portal. Here the citizens can find all initiatives achievements investments trade and business policies announcements publications statistics and others facts.

Click Continue under the return you want to open or. Now anyone can submit hisher return by log in wwwetaxnbrgovbd and can make their payment through wwwnbrepaymentgovbd. Provident Fund information if any Recognized Provident Fund RPF 4.

Process of Collecting User ID Password and Recovering Forgotten Password of Online Income Tax Return Submission in BangladeshFor Firefox and Internet Compa. If you are a withholding agent update your source tax deposit. Both procedures have their own merits and demerits.

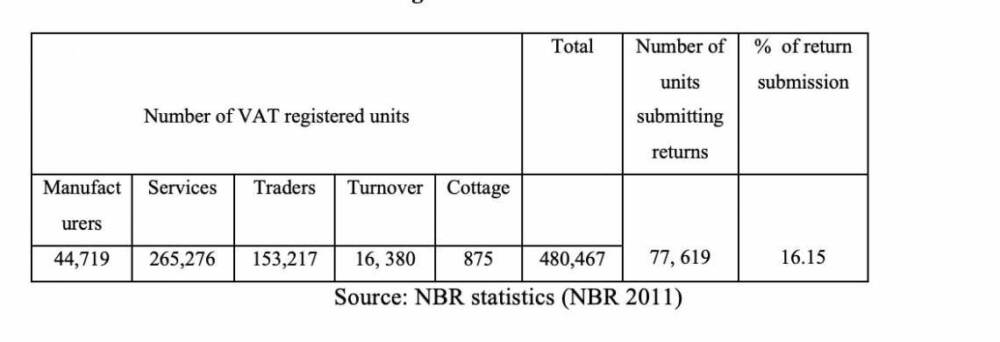

A person shall file a return of income to the DCT of the income year. A if the total income of the person during the income year exceeds the minimum tax threshold under this Ordinance. Turnover Tax applicable to turnover tax payer up to Taka 8 million is 3 VAT is not applicable to them.

The National Board of Revenue NBR is the apex authority for tax administration in Bangladesh. Copy of NID 4. A copy of the previous years return if you have already submitted the return For employees income from salary.

Pictures for the first time 3. An additional surcharge of 25 percent on income of companies in the tobacco sector. Update your tax payment.

It is a system guided easy-to-use tax preparation software that will save you time money and help you reduce any tax potential audits by the Government. The government earns by levying tax on the income generated by the population. Register as a taxpayer.

You will be required to fill out your personal details name National ID Number TIN names of parentsspouses etc. In addition NBR introduces online tax submission portal to facilitate tax payers. The government earns by levying tax on the income generated by the population.

Address current and permanent 5. B if such person was assessed to tax for any one of the three years immediately preceding that income year. Apart from Tax Zone 4 the NBR also launched piloting of the online tax filing system in Tangail in the run up to open the system for all taxpayers.

Pay your tax online. Click Next and select the particular form for which you want to input data. In order to verify a persons status of income and assets he has to submit an annual tax return copy to the government in prescribed manner.

If anyone follows the universal self assessment procedure they must have 12 digit Tax Identification Number TIN. However to do this every assessee needs to get user ID and password for the first time from concerned tax office. The National Web Portal of Bangladesh বলদশ is the single window of all information and services for citizens and other stakeholders.

Enter a unique user ID password a security question answer mobile number email ID and then verify the Captcha code and click on the Register button. File your tax return. Step 02 You will get an activation code on your Mobile Phone.

The filing date may be extended up to two months and further extension up to another two months by the tax authorities upon application. The rates of Tax applicable in Bangladesh are as follows. Step 01 Click on this link IncomeTaxGovbd and fill-up the form like the image below.

Online E Tin Registration And Income Tax Return 2021 22

How To Fill Income Tax Return 2019 2020 Bangla Itr 1 Submit Live Demo Youtube

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Income Tax Tds Certificate Form 3 Everything You Need To Know About Income Tax Tds Certifica Income Tax Return Income Tax Tax Forms

Nbr To Launch Online Tax Return Filing Service Nov 1 The Daily Star

Bangladesh Income Tax Chapter 1 Mohammad Zakaria Nikhil Chandra Pdf Public Economics Taxes

13 Digit Bin Registration In Bangladesh How To Get Bin Certificate Bin Registration Bangladesh Youtube

What Documents Require With Return Of Income To Nbr In Bangladesh

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Nbr Develops E Return Filing Model Nbr Member News Bangladesh Sangbad Sangstha Bss

How To Collect E Tin Certificate From Online In Bd Only 5 Minutes

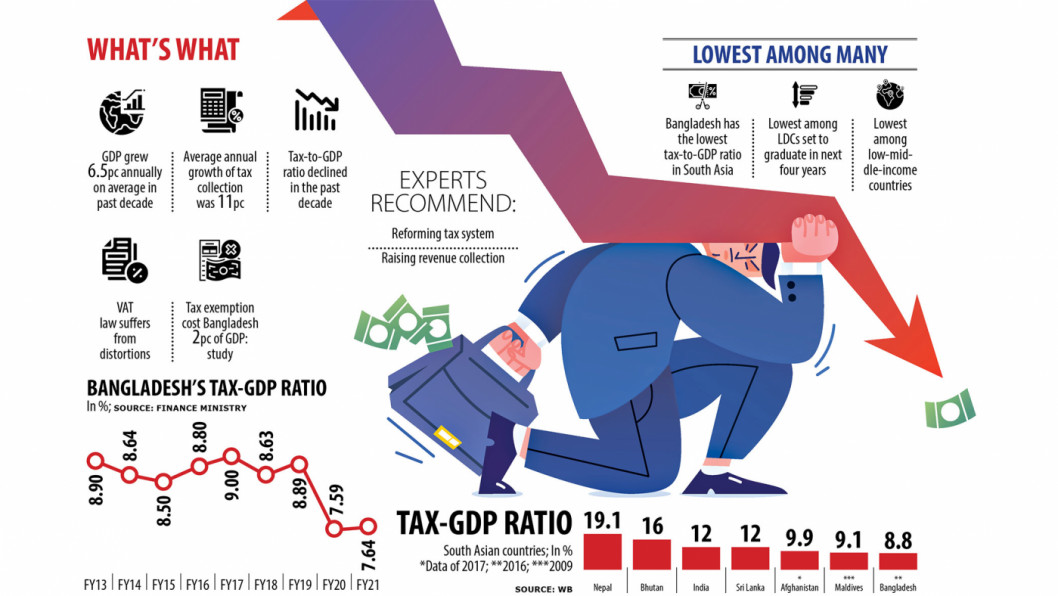

Bangladesh Gdp Growth Puzzling Low Tax Gdp Ratio Daily Star

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Income Tax Assessment Fillings In Bangladesh Youtube

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat